A foreign transaction fee is a percentage-based fee on all purchases abroad or online in foreign currencies. Usually, it is 1-3% of purchases for credit cards. It appears on the card’s monthly statement as an additional item or fee.

Let’s understand this with the help of an example. Suppose you made a purchase worth Rs 50000 from a foreign website. Considering the 3% transactional fee, it will cost you an additional 1500 rs.

The bigger the price of purchase, the bigger the transaction fee.

To avoid paying this extra amount, you can use a no foreign transaction fees credit card.

Still, needing clarification about Forex cards?

Read till the end to understand everything you need to know about No foreign transaction fee cards.

No foreign transaction fee cards can significantly help people who often shop online from abroad. It provides several benefits, some of which include

Several companies are issuing zero forex cards. Many of them provide additional benefits and limits. While choosing a Forex card make sure to cross check and compare the additional perks of different cards before finalizing one.

You can consider the following to choose a Forex card –

If you wish to avail a no forex credit card but have no idea what to go for, you can examine the suggestions given below and form an intelligent decision –

-Earn 3% cashback on all US purchases

-Earn 1.5% cash back every time you redeem Rogers, Fido, or Shaw purchases., etc

-Annual income of Rs 36 lakhs or more.

-300+ Brand Offers-2 complimentary domestic airport lounge and spa visits, etc

-Complimentary insurance cover

– Backup card facility available, etc.

-A good credit history

-Indian or Non Resident Indian (NRI)

-Travel and dining offer

– Airport lounge access, etc.

-Indian Resident.

-2 complimentary airport vouchers within India.

-E-Vouchers of top brands, etc.

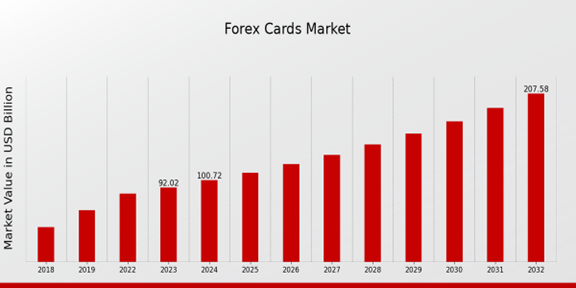

A gradual increase in foreign transactions has been observed in recent years leading to an increase in the forex card market too. The following graph depicts the rising demand and market for forex cards.

Foreign merchants tend to take advantage of tourists while converting currencies. Avoid signing checks and receipts that are not in the local currency of the country.

FUN FACTAccording to financial reports by three of the largest credit card companies in the world, there were already more than 1.65 billion credit cards existing in 2017. If you placed those cards end by end, 3.37 inches each, you could span more than 88 thousand miles; the equivalent of three and a half trips around the world.

People who regularly make foreign transactions have to pay additional amounts which might add up to a big figure. No Forex cards are of great relief for such people as they save them from paying extra money and even provide additional benefits to them.

As discussed in the article, there are a variety of cards to choose from. Different companies provide different perks with their cards. Be informed before finalizing what to buy, and make smart decisions. Make no transaction fee purchases with No Forex cards.

Also Read: Invest In Databricks Stock To Leverage High ROI

Yes, most of the card companies give this facility to load up to 15 different currencies in a single card.

It is a service provided to cardholders while shopping at foreign merchants. It allows them to pay in the issuing bank’s currency instead of the merchant’s local country currency.

You are required to pay additional foreign transaction charges while purchasing goods in foreign currency while using a regular card. On the other hand, zero forex cards allow you to make payments without additional changes.

Forex cards can be reloaded online or at any bank branch of the issuing company.

Yes, Different banks offer different validity periods. Most banks offer at least 5 years validity, once the card is loaded.