“The goal of accounting is not just to prepare financial statements; it’s to help the business to operate more effectively and profitably.”

It is obvious that every business owner would want to have an effective cash flow management system. Managing finances and cash flow is necessary for the success of any business. But it can be complicated, especially for small business owners who are new to this journey and don’t know much about how these things work.

Accounting software is one of the tools that can help in Small business accounting automation. Accounting software can automate more than half of accounting operations with fewer risks of manual errors, isn’t that what all business owners want?

In this article, we will discuss the role of accounting software in facilitating various accounting operations. So, Stick till the end and learn seven viable steps that can help you administer cash flow with accounting software.

If you are looking for ways to enhance cash flow in your business with the help of accounting software, Here are seven viable steps that will help you do so.

Real-time insights typically mean the information or updates generated immediately after an action. Real-time monetary insights can include the immediate generation of market data, transactional data, sensor data, and other relevant sources that provide data related to financial operations.

Accounting software plays a key role in real-time monetary analysis, assisting businesses in efficiently collecting, processing, and analyzing data.

It provides great help in making monetary decisions by

Bloomberg Terminal and Tableau are two widely used real-time monetary analysis tools.

DO YOU KNOW?The first accounting software, AccountEdge, was developed in the 1980s. It revolutionized business finance management.

Gone are the days when we used to receive a paper receipt for every purchase, accounting software has transformed traditional receipt management and tracking systems by automating the process.

Receipt generation, expense tracking, and data entry can all be done digitally, reducing the risk of manual error and allowing easier storage, retrieval, and organization of data.

Mechanizing receipt and tracking processes by accounting software not only enhances accuracy by minimizing the risk of error, but increases efficiency by streamlining processes and reducing burdens, better accessibility, and compliance as organized records promote regulatory compliance and audit.

Wave and Receipt Banks are two of the accounting software that help in digital receipt scanning and finance tracking.

It takes no genius to guess that receiving real-time financial analysis through accounting software can assist make better financial decisions at the right time, leading to better financial management.

Accounting software can play a great role in managing the financial asset cycle including appreciation, deprecation, and retirement, and making financial reports that provide a clear landscape of expenses.

Expensify and QuickBooks Online are two user-friendly accounting solutions that offer robust account management features allowing users to track expenses attach receipts, categorize spending, and generate reports.

Accounting software assists in various operations that help determine the cash flow, including –

Two accounting software that offer cash flow management tools and help businesses track their finances are Sage Business Cloud Accounting and Xero.

Vendors and suppliers play a major part throughout the operations, which is why vendor and supplier management becomes an important element to take care of, accounting software can help you with that in the following manner –

Zoho Books and FreshBooks allow you to effectively track bills, schedule payments, and report on vendor expenses.

Businesses need to have relevant metrics and KPIs to carry out business operations efficiently and make informed decisions. But don’t you think it will be too much of a hassle to analyze large amounts of data, and try making the whole report manually? This is also something that can be done with ease with the help of accounting software. They can effectively collect, and analyze data and create well-structured customized financial reports.

Accounting Seed and NetSuite allow effective customization of financial reports to suit complex business requirements.

It is not feasible for every business owner to set up a whole system dedicated to accounting software, but everyone has a mobile, and they can easily access applications in it. Various accounting software offers mobile access and cloud-based solutions that can be a great choice for many small business owners. These software programs can provide them with several benefits including real-time collaboration, automatic updates, data backup and security, customizable dashboards, notifications, and alerts.

Xero and Kashoo are two cloud-based accounting solutions with mobile apps that allow you to track incomes, manage invoices, and access reports on your mobile phones.

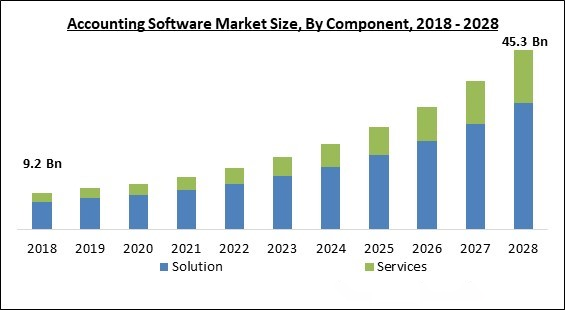

Accounting software is now widely being used by companies to improve their monetary operations. The graph below represents the accounting software market from 2018-2028.

After all we have discussed in this article, we can say that accounting software is nothing less than a wonder for business owners. From providing real-time monetary insights to assisting with vendor and supplier management, it can help in almost all accounting operations and the best part is that you don’t need any dedicated systems for the software, you can easily access accounting software on your mobile phone, isn’t that great?

In the end, we hope you found this article useful, and it helped you understand the role of accounting software for improving cash flow management.