The advancement of technology has led to a surge in sophisticated and methodical security crimes. According to a report by Javelin Strategy & Research, 1 in 4 US consumers experienced account takeover scams, with financial accounts being the chief target.

Security issues are one of the major challenges faced by banks. The finance industry is adopting various new strategies to prioritize security and enhance user experience.

Once Dan Schulman, CEO of PayPal, was asked about his take on the same, and he stated that, “To build a secure and trusted financial platform, we must prioritize identity verification and management. It’s the first line of defense against fraud.”

Effective identity and access management in banking is the cornerstone of financial security. Implementing proper identity management systems in the finance industry can work wonders to enhance its security system and build a secure banking environment.

In this article, we will discuss the importance of identity management and how it can strengthen various banking operations, so stay tuned till the end to learn more.

Identity management involves the identification, authentication, and authorization of users to make sure that the data or system is being shared with the right person. Identity management assigns a digital identity to each network identity.

After the identities are assigned, those identities are maintained and monitored throughout each user’s or device’s access lifecycle.

Banks are always priority targets for cybercriminals, hence it becomes necessary for banks to adopt sophisticated identity management techniques to safeguard their data. The points below explain why Identity management has become a crucial asset for banks –

Thousand of incidents of security crimes in banks have been reported in the past as banks are considered the prime targets for such offenses. Some of the challenges concerning financial security faced by banks are

onboarding and transaction monitoring systems to prevent any digital fraud incident.

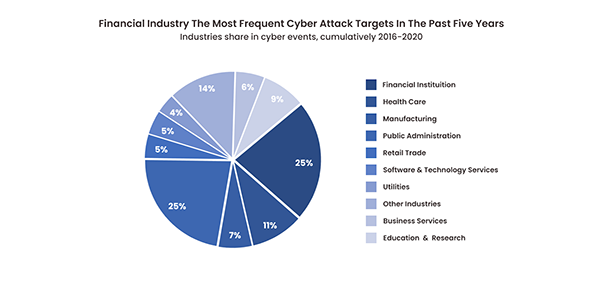

The financial industry has faced the major challenge of being the priority target of cyberattacks in the past five years.

To yield the most results, organizations must ensure that identity management tools are set up correctly and promise security. Let’s discuss five best practices that can help improve identity management

Zero trust security models always consider the worst-case scenario, i.e. breach and never trust. This requires the user to always fill in the password.

Methods such as biometrics (Fingerprint, facial recognition, iris scanning, etc.), Possession authentication (sending OTPs), and knowledge authentication (answering security questions). All these methods are hard to crack, hence considered a great method to ensure security.

Involving technologies such as machine learning and artificial intelligence in identity management significantly enhances the system’s efficacy.

AI-driven IAM systems are excellent at analyzing large volumes and providing real-time analytics that help companies manage user data and control access privileges.

Analyzing past data and activities, user behavior, and anomalies, helps the system in detecting potential security threats and act accordingly. Leveraging AI within identity management helps organizations enhance their security systems and elevate user experience.

The prime goal of IAM is to provide security and reduce the risk of unauthorized access. Five tips to mitigate risks are as follows-

DO YOU KNOW?Last year, 3,348 cyberattacks on the financial sector were reported globally, which is the highest since 2013. The reports of data breaches also increased from 690 in 2021 to 1,115 in 2023.

IAM helps ensure that only the right people have access to certain data. It has proven to be a great success in the banking industry. Some of the real-world examples that support its claim of being successful are-

There are several more real-life examples that prove the effectiveness of Identity management in the banking industry.

Identity management is the foundation of all banking operations. IAM solutions facilitate these operations by providing an effective mechanism for managing identities, enforcing digital control, and monitoring user activities.

This not only strengthens security but also provides a seamless customer experience across multiple channels.

IAM solutions have already proved to be a significant tool in the financial industry and will continue to play a central role in the future.

Also Read: 5 FinTech Strategies for Regulatory Compliance