Owning a car is freedom and opportunity at the same time, but it means big costs on fuel, maintenance, insurance, and taxes and that is the reason quite often this mode of transport becomes a bit of a money pit.

So to add parting with one’s comfort is not very feasible for many, though at the same time that doesn’t mean that cars should be beyond one’s affordability and prevent someone from making money in their life.

Thus, it is advisable to employ certain strategies that help you cut back on these costs without necessarily affecting the quality or safety of the car. Also, learn about Control Systems And Workplace Safety by reading this article.

Here are 10 steps you can take to save money on your car expenses-

One of the best ways to save money on car expenses is by staying on top of regular maintenance.

A well-maintained automobile is generally fuel-efficient, reliable, and has fewer chances of facing unexpected problems.

Here’s how regular maintenance helps reduce long-term costs-

On the other hand, skipping oil changes can cause dirty oil, leading to engine wear and its overheating.

This can eventually result in expensive engine replacement or rebuild.

Because the tires that wear unevenly or become bald increase the risk of blowouts, which not only lead to replacement costs but also safety risks.

Low or contaminated fluids can lead to overheating, poor performance, or transmission failure, all of which can push burdensome repair bills.

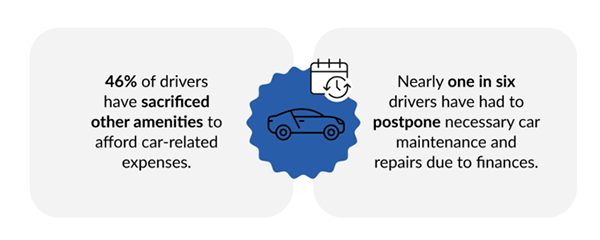

As per the research,

Since the beginning of 2022 to June 2024, repair costs have increased nearly 25%.

Insurance is one of the recurring costs that most car owners view as a fixed expense, but that doesn’t have to be the case.

Insurance rates vary a lot- your cost depends on your past driving record, the type of coverage you pick, and even the area you live in.

That’s why you must take your time to compare different insurance deals so that you are not overpaying.

That said, if you’re a careful driver and hardly ever make claims, higher deductibles can be a savvy way to cut your premium.

These could include, but are not limited to, safe driver discounts, discounts for using anti-theft devices, etc.

Must ask your provider what discounts are available and inquire as to if you qualify.

Your driving habits play a huge role in your car’s fuel consumption, for instance, aggressive driving, quick acceleration, speeding, and hard braking all waste fuel.

So, lighten up on the gas pedal to pocket more money at the pump, observe the speed limits, don’t idle too long, and if possible, use cruise control to maintain a steady speed.

Moreover, schedule and combine your errands for one trip instead of multiple trips, avoiding as many unnecessary miles as possible.

Another thing to note- inflated tires improve fuel efficiency and help you get the most out of every gallon.

With fluctuating fuel prices, finding affordable gas can be challenging, however, there are special apps that may help you identify the cheapest gas near you.

These include GasBuddy and Waze, both of which give real-time fuel prices and can help you save at the pump.

Consider enrolling in the loyalty program of a chain of filling stations as in most cases, they have discounts for regular customers or have tie-ups with credit card companies so that you can get a discount on the fuel purchased.

For repairing, you don’t need to visit the dealership for parts as there are aftermarket parts that are as reliable as the OEM parts, which can help save money.

There are, of course, circumstances when there is an absolute necessity to employ the use of OEM parts—for example, on high-end automobiles.

However, many aftermarket parts really are as efficient and, more to the point, available at a mere fraction of the cost.

Before any repair, ask about your options and do your research, and you will find many common parts available in the market, like batteries or brake pads; you can often find affordable, high-quality alternatives that meet the same standards as dealership parts.

When purchasing a car, it’s easy to get swayed by the appeal of luxury features and add-ons that seem beneficial at the moment.

However, such features come with price tags of their own and generally contribute a thousand or so to your final car price.

A good way to check the budget at all levels of car expense would be to avoid paying for unnecessary features or added-on frills and concentrate on what’s necessary.

For instance, leather seating, a sunroof, and a premium sound system are maybe tempting, but these only make the price higher and do not necessarily add value to your car over the long term.

Think through need-verses-want – advanced braking systems, backup cameras, or other components will be worth a great deal more than a cosmetic upgrade; you don’t need CarPlay when just $11 FM transmitters can do just a good job.

At the point of sale, a dealer may try to sell you extended warranties, paint protection, fabric protection, or anti-theft devices.

Some of them offer a bit of peace of mind, when others tend to be overpriced or superfluous.

An example of it may be extended warranties which often duplicate coverage already provided by the manufacturer or your insurance, making them unnecessary expenses.

New cars drastically reduce their value the very moment they hit the road and are thus a significant expense, thus used or certified used vehicles can save you thousands.

CPO cars, in particular, have undergone inspections and often come with warranties, giving you peace of mind similar to buying new.

When it may not always be practical, reducing the amount you drive is a surefire way to cut costs.

Carpooling with friends or colleagues can reduce the use of fuel and car maintenance, or the use of public transport for some days of the week can reduce your dependency on your car.

This not only saves you money on gas but also reduces car’s wear and tear, lengthening the lifespan of your vehicle and putting off expensive repairs or replacements.

Your credit score will greatly determine the interest rates you’re offered for car loans and may even determine your insurance premiums.

A high credit score will justify better rates on the loan, translating into monthly payments at a lower rate, and also translate into lower total interest paid over the life of the loan.

Also, when financing a car, you must consider refinancing your loan if your credit score has improved since you first got the loan.

Moreover, lowering your interest rate can save you hundreds or even thousands over the life of the loan.

You do not need a degree in mechanics to handle some basic tasks and issues related to car maintenance.

For example, how to change oil, replace windshield wipers, or put in new headlights—whatever it is—this can save you a wad of moolah, and also there are a bunch of tutorials on how to do all this.

Even if you’re not comfortable handling these tasks on your own, understanding the process helps you avoid being overcharged when you take your car to a mechanic.

Managing expenses that come with a car should not give you sleepless nights.

By adopting these smart strategies, you can significantly cut down on costs, at the same time maintaining the safety and performance of your vehicle.

From general maintenance and good driving to comparing insurance alternatives, there are plenty of options to reduce the financial burden of owning a car.

The key is to stay proactive, make informed choices, and always look for savings where possible.