No, it is a privately held company and can’t be accessed on public exchanges such as NASDAQ or NYSE. However, accredited investors can invest prior in the company through secondary platforms like EquityBee, Forge Global, Hiive, SoFi, Extrade, etc.

In this evolving world of technology, various ML, AI, and data intelligence companies are gaining popularity and shaping the future. These companies generate high revenues and are considered a safer option for investment to gain long-term returns.

Databricks is one such start-up that is in the limelight because of its financial performance and IPO. According to CNBC, Databricks stock valuation in 2021 was $38 billion, which increased to $43 billion after the additional round of funding in 2023.

In this article, we are going to disclose the Databricks IPO status and release date, financial position, investment process, and some alternatives to leverage the maximum return on investment.

Databricks is a data intelligence company that offers a unified analytics platform to assist with large data processing and machine learning tasks. The company was launched in 2013 with its headquarters in San Francisco, California. It is streamlining the data analytics workflow with various functions like data engineering, data science, and machine learning and is known for creating Delta Lake, MLflow, and Koalas.

The company is using Lakehouse, a cloud-based platform that allows you to access and analyze data and store it on third-party cloud servers.

Databricks has yet to launch an Initial Public Offering (IPO), so it is not a publicly traded company listed on popular stock exchanges such as NASDAQ or NYSE. As per the reports, the company announced to release of its IPO in mid-2023, however, later the plans were canceled because of the poor market conditions.

Till then, no further announcement regarding the IPO date has been made by the Databricks’ CEO and the team. Therefore, we’re still waiting for information on the pricing and dates of the company.

As we have informed you, Databricks does not trade publicly. You can still invest in it through some secondary platforms, which allows you to invest in venture capital-backed start-ups if you’re an accredited investor. The process to invest in Databrick stock is given below:

Several platforms that you can pick for buying Databricks stock include SoFi, Tastytrade, Public.com, Robinhood, E*Trade, EquityBee, Forge Global, and others.

Do you know?

Accredited investors are defined as those who have a high net worth or income. This makes them risk-takers, granting them access to higher-risk investments.

Many investors are unsure whether to invest in the Databrick IPO when it launches. This is because the company isn’t profitable yet. But let us inform you, this is common with new technology companies.

These early growth firms invest heavily in their innovation, technological aspects, and scaling up the business, which takes years to reach the profitability standard. Hence, this is too early to reject Databricks and you can be indifferent to make the investment decision.

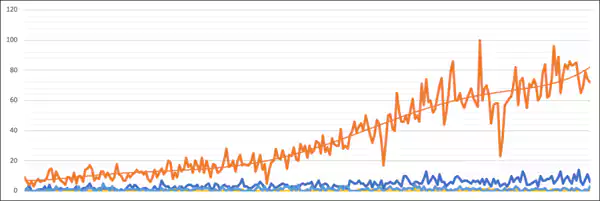

Databricks is among the top-growing data software companies with high revenue and valuation in the market. In 2023, the Annual Recurring Revenue (ARR) run rate crossed the $1.5 billion target.

Regarding valuation, the company previously invited private investors in 2023. During the process, it raised a fund of $500 million at a valuation of $43 billion. Previously, it doubled in 2019 and quadrupled in 2021. Databricks’ valuation multiple is much better than other mature publicly traded companies in the same field.

If you’re not an accredited investor and are interested in getting some exposure to other growing companies in the cloud data sector, you can consider some other publicly traded database companies that are given below:

This data cloud company helps you store, process, and analyze data faster and more effectively. In 2023, the company soared a revenue of 69%, which was almost $2.1 billion with a market cap of $60 billion.

However, Snowflakes faced a GAAP net loss of nearly $800 million in the same fiscal year. But it was profitable on a non-GAAP basis, generating $95.3 million of non-GAAP net income. With a positive free cash flow of $520.4 million, the company has no debts and can expand its business. With such strong financials, Snowflakes was able to approve a $2 billion share repurchase program in early 2023. The price/earning growth ratio, PEG of the company is 3.064.

Cloudera, Inc. offers data analytics and management products in the US, Europe, and Asia. The company provides different software like Cloudera DataFlow, Cloudera Data Science Workbench, Cloudera Enterprise Data Hub, Cloudera Data Warehouse, Cloudera Operational DB, and others. The company has a market cap of more than $4 billion, a PEG ratio of -0.84, and a 0% dividend yield.

It is a document database that uses a flexible approach to serve clients to directly collect data while building applications. In the 2023 fiscal year, the company’s total revenue increased 47% to almost $1.3 billion. In the same year, the market cap of MongoDB was nearly $30 billion.

However, in 2023, MongoDB faced a GAAP operating loss of $345.4 million. Non-GAAP results included $64.7 million in net income and $24.7 million in free cash flow. This rich financial position of the company makes it a great choice for investment.

It is another well-known investment option that creates and maintains software, devices, services, and support around the world. It offers services like Office, SharePoint, Exchange, Microsoft Teams, Office 365 Security, LinkedIn, Dynamics 365, azure, SQL, Bing, Microsoft News, and much more.

Not only that, but it is one of the biggest organizations in this sector with a market cap of more than $3 trillion, a P/E ratio of 36.77, a PEG ratio of 2.02, a dividend yield of 0.0071%.

All these companies and their financial performance will improve in the future with an upward-sloping graph due to the rise in the demand for AI, data, and cloud-based services. Hence, they are considered to be safe for investment to generate a return in the long term.

With AI technology accelerating, Databricks stock is rapidly increasing, making it a great investment option. Databricks has already received investments from Fidelity, Nvidia, Morgan Stanley, Andreessen Horowitz, Capital One Ventures, Green Bay Ventures, Franklin Templeton, and other prominent investors.

As a result, you should analyze the company’s financial books and reports and invest your funds once the IPO is launched.

No, it is a privately held company and can’t be accessed on public exchanges such as NASDAQ or NYSE. However, accredited investors can invest prior in the company through secondary platforms like EquityBee, Forge Global, Hiive, SoFi, Extrade, etc.

The company does not have a public stock price as it is a privately held company.

Databricks’ investors include Morgan Stanley, Andreessen Horowitz, Tiger Global Management, Green Bay Ventures, and many others.

Unfortunately, not at present as the company is not publicly traded. However, if you’re an accredited investor you can buy some pre-IPO shares.